here to help you grow.

Digital Application

Apply for Financing

Competitive Rates. Creative Financing Programs.

- Low rates and competitive structures

- Application only up to $500,000

- 3 & 6 month deferrals

- $0 down w/ terms up to 72 months

- eDocs available

- Pre-funding available

- No pre-payment penalty

90% approval ratio and over $2 billion funded.

No one understands the position our clients are in better than we do. For many businesses, the need for the latest commercial equipment is paramount in order to grow their business. For others, this equipment is necessary to maintain their leadership position in their field.

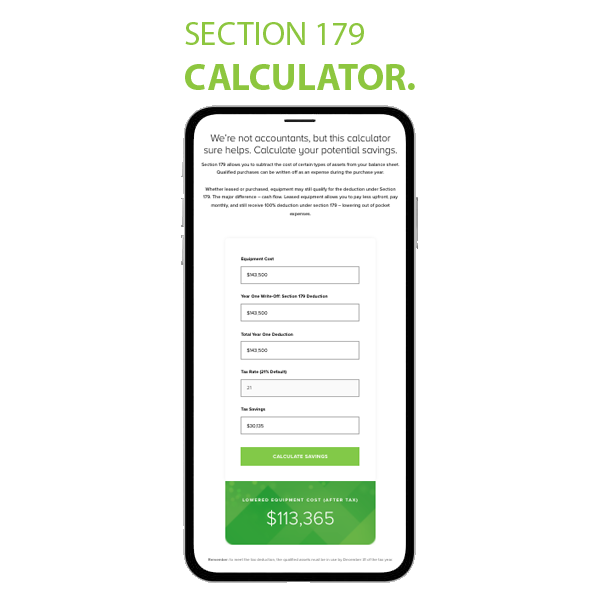

Section 179 Tax Savings

Allows you to subtract the cost of certain types of assets from your balance sheet. Qualified purchases can be written off as an expense during the purchase year.

Whether leased or purchased, equipment may still qualify for the deduction under Section 179. The major difference – cash flow. Leased equipment allows you to pay less upfront, pay monthly, and still receive 100% deduction under section 179 – lowering out of pocket expenses.

In seven-minutes: read the guide, calculate your potential savings, and learn how to deduct equipment.