here to help you grow.

Digital Application

Apply for Financing

Kevin Davey

Kevin Davey

Finance Manager – Asset Funding

Cell. (414) 241-9448

Office. (603) 241-4875

Email. kdavey@financialpc.com

LinkedIn. Kevin Davey

Competitive Rates. Creative Financing Programs.

- Low rates and competitive structures

- Application only up to $500,000

- 3 & 6 month deferrals

- $0 down w/ terms up to 72 months

- eDocs available

- Pre-funding available

- No pre-payment penalty

Our knowledge and industry experience is vast. So are our banking relationships. This allows FPG to assist in any type of situation — no matter how commonplace or unique. So no matter the need, the machine, the industry or the timeline, we deliver. But it’s the way we deliver that matters most. Customer satisfaction is our top priority. From the early stages of the application process through sales funding, our team and support staff are available every step of the way to aid, assist and answer questions that arise.

90% approval ratio and over $2 billion funded.

No one understands the position our clients are in better than we do. For many businesses, the need for the latest commercial equipment is paramount in order to grow their business. For others, this equipment is necessary to maintain their leadership position in their field.

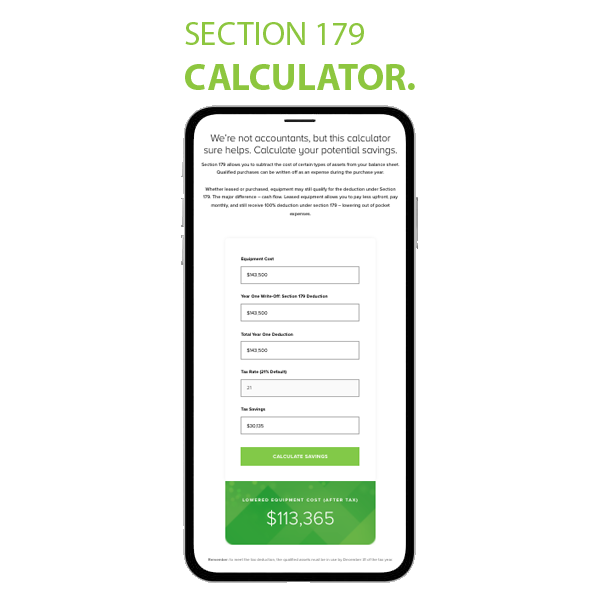

Section 179 Tax Savings

Allows you to subtract the cost of certain types of assets from your balance sheet. Qualified purchases can be written off as an expense during the purchase year.

Whether leased or purchased, equipment may still qualify for the deduction under Section 179. The major difference – cash flow. Leased equipment allows you to pay less upfront, pay monthly, and still receive 100% deduction under section 179 – lowering out of pocket expenses.

In seven-minutes:

- Read the guide

- Calculate your potential savings

- Learn how to deduct equipment